Back

to Main "No - T-SPLOST" page

- - Give Ga DOT a "WAKE-UP!" call

- -

|

Vote |

| Other Websites: Traffic-Truth |

Join

us on Facebook  1- No T-SLOST for Mid-Georgia 2- www.facebook.com/NoTSPLOST |

This Cent makes No $en$e

| |

Recent

Articles |

|

| Member of the TSPLOST group

does an about-face..

Legislator says some proposed spending is illegal (here)

“I believe that TSPLOST is unconstitutional,” said State Rep. Billy Horne, R-Sharpsburg. At the Senoia Tea Party town hall (here). State NAACP opposes the TSPLOST (here) Red State's Erick Erickson opposes the TSPLOST (here) Lengthy and Comprehensive Analysis by Georgia Policy.org |

||

| No More Secret Road Meetings! |

||

|

- GDOT Breaks Open Meeting Laws

-

What happens to your road-tax-money behind closed doors? |

||

| No More Anonymous Roads

Officials! |

||

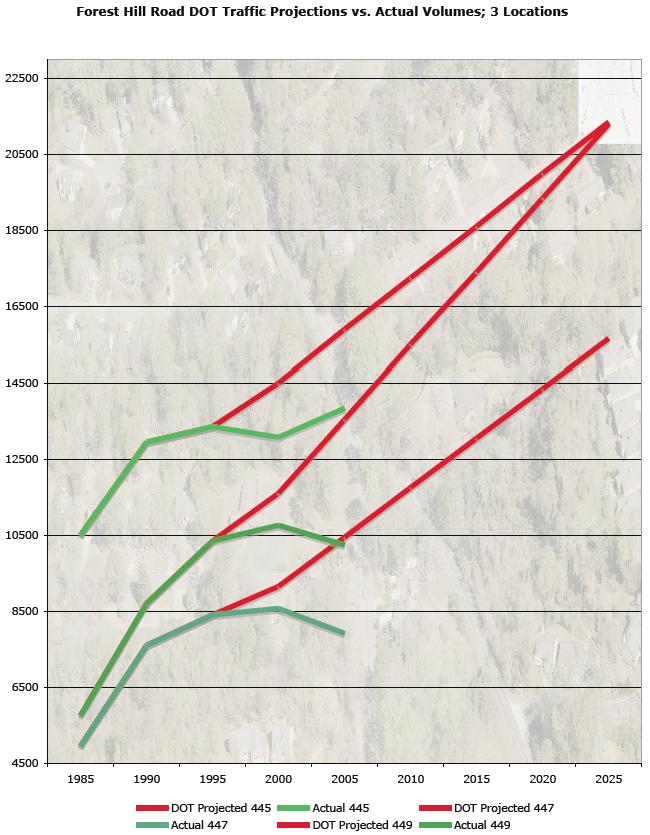

Anonymous Attendee said that

his construction Projections are more Precise than Actual

tube ADT Counts What gives with a GDOT official refusing to give his name to a citizen? |

||

| No More NONSEN$E Traffic

Projections! |

||

|

||

| N O S P L O S T |

|

|

T-SPLOST shortfall If you want to complete all the projects approved on the Region 6 -- Middle Georgia T-SPLOST constrained project list, your county is going to need more money. There is a $525,399,933 shortfall from the GDOT projected costs of more than $1 billion for all the projects and dollars committed to all the projects. These are based on 2011 numbers. Therefore only 51 percent of the projects are completely funded by the new T-SPLOST. The counties in Region 6 will need to make up the dollar shortfall from other sources or drop projects from the list. The vast majority of the projects don’t begin until 2016 or beyond for good reason; there are not enough technically skilled people to start all the projects immediately nor have they collected enough money to start the projects. As more and more of your county projects are unfunded you become more of a tax donor county. The GDOT still gets its $7.8 million in program fees already approved in the T-SPLOST, but you paid that money for nothing. -- Bill Evelyn Director State of Georgia Tea Party, LLC published at www.macon.com on 2012/03/25 |

|

|

|

||

T-SPLOST raises several questions Friday, April 27. 2012 It was really no surprise this week that the Jackson County Chamber of Commerce voted to support the July 31 vote on T-SPLOST. But questions remain. The T-SPLOST move is an effort to add another penny sales tax for new funds to pay for various transportation needs in the region. This is not a statewide vote, however, it is a regional vote, the first of its kind. Jackson, along with 11 other counties, will vote on whether or not to levy the tax in the Northeast Georgia region. A number of regional, county and city road projects have been targeted for those funds if approved. But approval isn't by county; if Jackson County citizens vote against the idea, but a majority in the region are in favor, then the tax will be imposed. While there is little argument that some areas of the state (especially Metro Atlanta) need to upgrade roads, there is much disagreement about whether T-SPLOST is the answer. Given the state of the economy and the sour reputation of government, there is no assurance that this additional sales tax will pass. There are three main questions that remain unresolved in the T-SPLOST effort: 1. Is the T-SPLOST regional vote Constitutional? When discussion began several years ago about a sales tax on a regional basis for transportation, most state political leaders assumed it would be paired with a Georgia Constitutional amendment allowing for regional, multi-county tax districts. Currently, the state constitution only allows state-wide or local tax districts. But when the state began to move on this bill in 2010, that provision for a constitutional amendment was gone. This year, a Republican legislator from Northwest Georgia attempted to have the T-SPLOST vote delayed until the state could get such an amendment. That effort failed. So there is a question about the legality of regional taxing districts that could tie the entire issue up in the courts if the measure passes. The essential question is: Can larger population counties in a region impose a sales tax on the smaller counties even if the smaller counties vote against the T-SPLOST? 2. The second question about T-SPLOST is whether or not the Georgia Department of Transportation should be given millions of new dollars to waste. A 2009 audit found that the GDOT was so unorganized "to the extent that GDOT was ripe for fraud, waste, abuse and mismanagement."¯ Then Gov. Sonny Perdue likened the GDOT's operations as "Enron-type accounting."¯ As a result of that scathing audit, the federal government froze GDOT's grants. None of this was a surprise. The GDOT has long been mismanaged; it is a political hothouse where influence peddling and political weight is used to make road decisions. So is the T-SPLOST really needed, or will those dollars also fall into the pit of waste and abuse that has long defined the state's top transportation agency? Adding to that are the inane decisions that routinely define GDOT operations. Need a traffic light at a dangerous intersection? According to GDOT, you have to wait until enough people get killed to justify that (remember the fight over the need for a traffic light at the Kroger intersection in Jefferson? It was the city that finally funded that much needed light because GDOT wouldn't do it.) And what about those HOT lanes now going into Atlanta? Despite the fact that taxes built that section of I-85, now drivers have to pay extra if they use that lane. The HOT lane created a traffic nightmare because it took away a large percentage of the interstate's carrying capacity. Given the GDOT's history of waste, abuse and inane decisions, should we vote to give them even more tax money? 3. The final question about the T-SPLOST relates to a provision in the law that would punish counties in a region that fail to approve the new tax. Although legislators have framed the vote as letting taxpayers decide, they didn't create a level playing field for the vote. If a region fails to approve the tax, then the state will punish the counties in that region by forcing them to match state funds at a higher rate. Rather than a state 30 percent match, counties would have only a 10 percent state match. That's not a fair system. It's like saying you have the right to vote on an issue, but with a gun pointed to your head: "Vote my way or die."¯ Such smarmy tactics are a discredit to good government. If the T-SPLOST issue has merit, then why did the legislature create a punishment for regions that didnā€™t want the new tax? There is a strong anti-tax sentiment today. As the economy has floundered, the private sector has been much harder hit by cutbacks than the government sector. Many public agencies have continued to spend rather than making cuts. The public isn't amused and has given a strong voice to the idea of "no new taxes."¯ Still, the public often supports sales taxes, figuring that they can't fight higher taxes and that at least with sales taxes, everyone pays something. It will be interesting to see how the public feels when the T-SPLOST comes up for a vote in July. Mike Buffington is co-publisher of Mainstreet Newspapers. He can be reached at mike@mainstreetnews.com http://www.jacksonheraldtoday.com/archives/7044-T-SPLOST-raises-several-questions.html |

||

http://sandysprings.patch.com/articles/t-splost-likened-to-bernie-madoff-scam

T-SPLOST Likened to Bernie Madoff Scam Nearby Sandy Springs: Mike Lowry is active in community affairs in North Fulton. It appears on close inspection that Georgia Department of Transportation (GDOT) may have engineered a financial coup with the T-SPLOST vote. Most supporters of T-SPLOST think we will get both T-SPLOST funds and our regular state and federal tax funds for road projects. But there is a not-very-visible term in the bill that may cost our area to lose hundreds of millions of dollars of funds that taxpayers have paid and should be returned to our region. The ugly little secret is that the state (that's GDOT) is also listed as a benefactor of the regional funds. This will be a legislative scam on a bigger scale than Bernie Madoff. This is much more than giving the people an opportunity to vote themselves a tax. This is "theft by taking." If any elected official voted for this knowing that the regions would lose money through "redirection" of funds, they need to be held accountable for their actions. The result of this little redirection could produce a gigantic GDOT slush fund to subsidize MARTA (500 million/year) and the other Atlanta area rail projects that are not fully funded by the "final list" that we are voting on. After several conversations with local chamber of commerce representatives and both city council members and some state representatives it is clear that few understood how regional tax funds will be "redirected" by the GDOT to other projects both inside and outside the region. After review of four GDOT presentations and reading their presentation on their website I thought I understood the program. However, looking at the FAQ on their website they explain in no uncertain terms how state and federal tax funds going into the region will be "redirected." Here are some quotes from the GDOT website under FAQ: Why is Georgia building additional projects when we are having difficulty maintaining the current system? …. In regions that pass the referendum, the revenues generated will supplement funding already appropriated for projects and allow Georgia DOT to redirect federal funding on maintaining our existing roadway. Can the revenue raised from the regional sales tax be used to match federal funds? Yes. There are many projects in the federal-aid pipeline that are good candidates for the regional sales tax. Helping fund the required match with regional sales tax dollars will allow state and local funds to be redirected to other projects. What happens if a project chosen for the region's project list is already programmed with federal, state or local funding? If federal funds are replaced by the regional sales tax funds this will allow other projects to advance in the Statewide Transportation Improvement Program (STIP)…. The following interpretation comes from Nolan Cox of Valdosta, he says: These quotes make it clear that regional funds will be used and state and federal funds "redirected" to other state projects. Since money is fungible, this means they will use our T-SPLOST dollars to "free up" already-committed state and federal funds to use as they wish. This can affect as much as 60 percent of the projects. I do not believe the mayors and county commissioners working on the Roundtable and the Executive Committee realized this. In fact, I suspect many legislators and the general public may not understand the shifting or redirection of funds. Under GA Code 32-5-30 Congressional District Balancing our federal and state fuel tax funds are returned in equal amounts to each district over a five-year period. Since Congressional districts and Transportation Investment Act (TIA) regions are different, the legal and most convenient way to "redirect" funds is from the TIA regions. That is why "the state" is listed as a benefactor of TIA funds on the ballot question. If "money raised in the region stays in the region" as GDOT says, why does "the state" need to be listed as a recipient of regional tax funds? They do not, but they are. By listing "the state" as a benefactor of regional funds, this makes it legal to "redirect" regional funds instead of federal and state funds as the FAQ explains. This means the regions lose a huge portion of the state and federal tax moneys they have paid in in fuel taxes. This makes a "bad deal" a "worse deal" for taxpayers, cities and counties. Stop the scam, vote NO on T-SPLOST. |

The Sierra Club explains Why Voters should say NO to the T-SPLOST and YES to "Plan B" here |

||

Talkin’ TSPLOST and the tax digest: Property owners hear from Rep. Powell and Hart County tax commissioner By Vivian Morgan, Staff writer http://www.thehartwellsun.com/articles/2012/05/23/news/news01.txt State Rep. Alan Powell pulled no punches Monday when he spoke to the Hart County Property Owners Association about a statewide Transportation Special Purpose Local Option Sales Tax that comes up for vote July 31. “If something smells like a skunk it probably is,” said Powell, who voted against the TSPLOST in the Georgia General Assembly. “This didn’t pass the smell test three years ago. The legislature was threatened to pass this and it was set to come to a vote three years later. Folks need to stand up to this.” The TSPLOST is a one-cent tax, scheduled to be in place for 10 years, that will fund specific regional transportation projects. Under the Transportation Investment Act, the state has been divided into 12 regions and each region will vote on the referendum. While the majority of the money will be used regionally, 25 percent of the funds raised will be distributed to the counties and municipalities for use on infrastructure and transportation projects they deem necessary. The entire state-wide project, if approved by the voters, will generate $18.5 billion in transportation funds over the 10-year period. According to information provided by www.ConnectGeorgiaMountains.org, the Georgia Mountains region will receive $1.2 billion and more than 34,000 jobs will be created. Included in that region are Hart, Stephens, Franklin, Banks, Dawson, Forsyth, Habersham, Hall, Lumpkin, Rabun, Towns, Union and White counties. Of the $1.2 billion projected for the region, Hart County is scheduled for three small projects, which include improvements on Highway 59; a widening of Highway 77 from Interstate 85 for a mile south; and intersection improvements at North Hart Elementary School. The proposed funding for these three projects is $13,889,874. Hart County will also receive $1,684,886 to use on additional projects. The problem, however, says Hart County Commissioner Dan Reyen is that the county will receive approximately $13 million but pay out approximately $25 million in taxes. “If you look at what the county is promised, how much we are going to pay in that 10-year period, we are going to be a general donor county to Atlanta,” Reyen said during the May 21 POA meeting. Powell says there’s an even bigger problem. “There’s a poison pill in there,” Powell said. “We won’t be penalized if our whole district votes against it. We will be penalized if we vote against it and the majority of the district votes for it. It amazes me how this has been on the books over two years and nobody has filed a lawsuit against it.” According to www.ConnectGeorgiaMountains.org., all local governments are required to match state funds in order to receive their state local maintenance grant. If Hart County, or any county, votes down the transportation referendum, the local match will be 30 percent, but if the project is adopted the local match will only be 10 percent. The only way a county cannot be penalized is if the entire region votes down the referendum. In addition, if the region as a whole votes in favor of the referendum, all counties in the region are required to participate. “What I am particularly upset about is the penalty,” said POA president Garry Hamilton. “It’s coercion and, on the worse side, it’s trying to buy your vote. I don’t know if this is legal or not but I do know that it lacks credibility.” Powell said that voters also need to be informed about hidden expenses. “We need to look at how much money is going to be taken out for administrative costs,” he said. “We’re 100 miles from Atlanta. We’re not part of the Atlanta clique. We’re part of the mountain clique. This project was created to drive more money into the metropolitan Atlanta area. That’s were this was created. The power structure has grown around Fulton and the 20 counties that surround it. They want more money to pour more concrete in Atlanta.” Powell went on to state that the entire project “smacks in the face of common sense,” and that when a regional roundtable was established to approve the final list of projects, each county was allowed two members to sit at the table. Hart County’s representatives were county commissioner Brandon Johnson and Royston Mayor David Jordan. “I think there was a flaw in this representation,” Powell said, emphasizing that he felt that a different type of representation should have come out of Hart County. In addition, Powell told the POA that he believes transportation construction should be funded by motor fuel taxes. “You would think gas would pay for roads, not tax on a loaf of bread,” he said, explaining that the long-term effect on public policy and taxation is going to be a problem. “This TSPLOST will lock the system down. Eighteen billion dollars in 10 years is a drop in the bucket for transportation funding. They will come back to ask for more money.” |

||

| |

||

|

|

SPLOST-Watchers Meetings Contact us by email - Tax-Payer@Macon-Bibb.com Thank-you! |

|

| |

||

|

Why is it important that any SPLOST must have great oversight by independent citizens?

|

|

Vote "NO" to secrecy.

Vote "No

Confidence" in the Road Officials |

| |

Voters must Insist on full disclosure and oversight of

meetings of the Road Officials and the Bibb County

Commission.

Highwaymen and the Commission must webposting of all minutes -

both provisional and final. Insist on taping and

television broadcast of all meetings.

<<-->> Send these elected officials a message

<<-->>

Vote "NO" on SPLOST - July 31, 2012.

Contact us by email - Tax-Payer@Macon-Bibb.com

Thank-you!

Final Note on the 2010 SPLOST-

Bibb voters defeated it

by a landslide on 7-20-2010 - -Do it again, now! - -

- END of Story